ADDX Tokenization platform from Singapore set to expand into the GCC and the Middle East

2 min

ADDX unveils a bold expansion strategy that targets MENA's pre-IPO blockchain landscape.

Global Tokenization Showdown: ADDX and securitize eye new territories for growth.

Singapore's ADDX is set to revolutionize MENA funding with Blockchain power.

Singapore-based ADDX has unveiled its strategy to penetrate the Middle East and North Africa (MENA) regions. Supported by US$140 million from venture capital, with significant contributions from major Asian financial powerhouses like the Singapore Exchange (SGX) and the Stock Exchange of Thailand (SET), ADDX is set to revolutionize the region's funding scene.

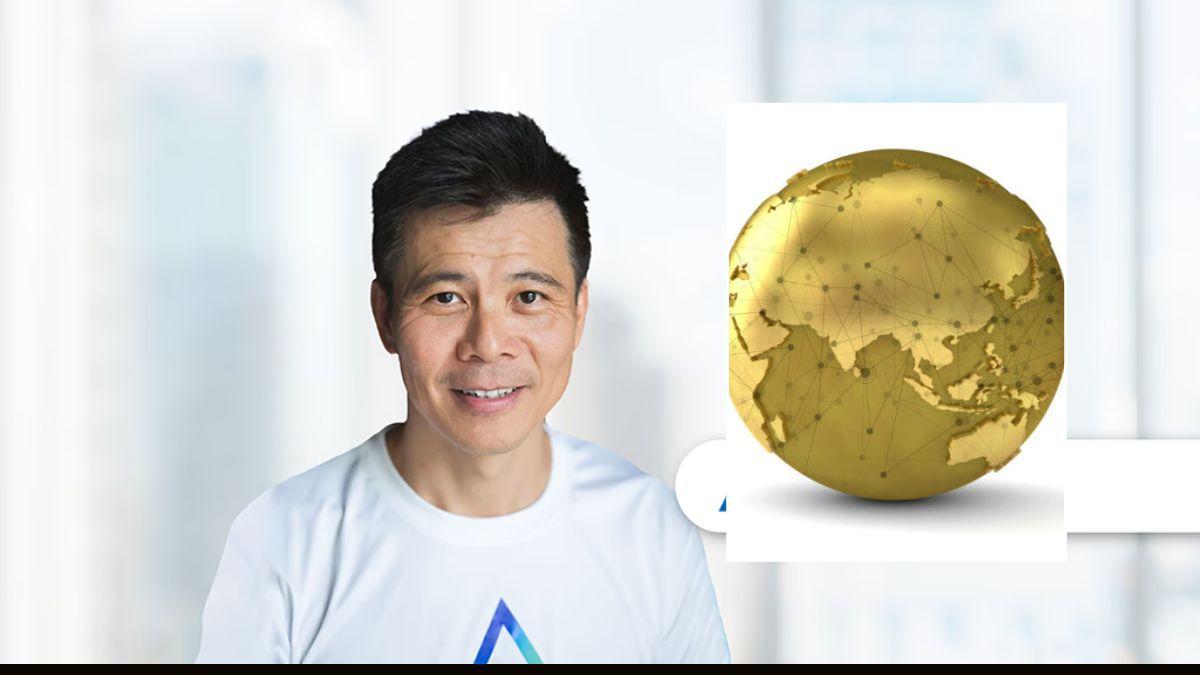

The platform's move into MENA is designed to assist pre-IPO firms in harnessing the power of blockchain for fundraising. "Our vision is to intensify the economic synergy and capital flow between vital APAC and Middle Eastern markets, simultaneously promoting the sustained growth of regionally crucial MSMEs," remarked Danny Toe, ADDX's founder and Group CEO.

With a history of listing over 80 deals, ADDX isn't just a platform for pre-IPO companies. They notably assisted SingTel in a $100 million bond issuance and saw various asset managers launch funds on their platform. ADDX's vast asset portfolio encompasses private equity, venture capital, funds, real estate, and structured products. Renowned entities associated with ADDX contain Hamilton Lane, Partners Group, Investcorp, Singtel, UOB, CGS-CIMB, and some under Temasek's umbrella.

ADDX's distinctive feature is its capability to fractionalize assets. While this allows for smaller investment denominations than traditional markets, it's important to note that only accredited investors can partake.

In 2021, prior to their recent funding surge, ADDX witnessed $150 million in yearly transactions. The platform was contacted for more recent figures but has yet to provide them at the time of this report.

Tokenization Scene Insights

Globally, Securitize emerges as a potential rival for ADDX. Having raised $75 million in venture funds, Securitize has channeled it into several strategic acquisitions, including businesses with a secondary market license and a veteran transfer agent. They recently integrated OnRamp, catering to investment advisors.

While Securitize, with its 200 issuers, continues to grow, its geographical overlap with ADDX is minimal. Headquartered in the U.S. and boasting a Japanese branch (like ADDX, which has Japanese investors), Securitize is now eyeing Europe and maintains existing setups in Israel and Argentina. It's noteworthy that both startups collaborate with Hamilton Lane.

The biggest stories delivered to your inbox.

By clicking 'Register', you accept Arageek's Terms, Privacy Policy, and agree to receive our newsletter.

Comments

Contribute to the discussion